Many small businesses use a cloud-based inventory management system that provides real-time data when needed. Beyond the tools a company may use, it’s also critical to have a consistent system to track all inventory. Common methods include batch tracking, demand forecasting, and bulk shipments. The accrual method recognizes revenue and expenses on the day the transaction takes place, regardless of whether or not it’s been received or paid. This method is more commonly used as it more accurately depicts the performance of a business over time. The cash method recognizes revenue and expenses on the day they’re actually received or paid.

Consider a professional service or CPA.

Business accounting provides companies with the financial insight and records to make strategic and smart projections and budgets. Stagger bill payments and have a system or methodology behind when and how you pay certain bills. Allow electronic payment systems, which is more convenient and faster in many cases. Finally, structure payroll in billing cycles that flow well with the company’s income stream. This means timing the frequency and amount of payouts in congruence with other business expenses and payouts.

Basic Accounting Documents

Depending on the nature of your business, how you collect money will vary. Employees and independent contractors are classified differently and give your business different tax deductions. If only bookkeeping meant hoarding the paperbacks I overbuy from my local bookstore — I’d be really good at that. If forensics brings up images of NCIS crime scenes, your deductive skills are up to par! Forensic accounting does require a certain degree of digging and detective work.

- Shareholders’ equity represents a company’s net worth — the amount shareholders would receive if they liquidated all assets and repaid all debts.

- Because of this, many publicly traded companies report both GAAP and non-GAAP income.

- If not, I know I need to investigate and correct any discrepancies before moving forward.

- Not to be confused with your personal debit and credit cards, debits and credits are foundational accounting terms to know.

- The term also appears in a type of business structure known as a limited liability company (LLC).

- Once the adjusting entries are made, an adjusted trial balance must be prepared.

- Creating your own small business might be one of the hardest things you ever do—but we have complete confidence that you can handle it.

Review inventory.

Accounting involves recording, classifying, reporting, and summarizing financial transactions. The goal of small business accounting is to provide financial information about the business to its stakeholders and llc bookkeeping regulators and for tax purposes. You can also use this information internally to decide how to allocate resources and manage risks. A good small business accounting system can also enable you to keep your business running efficiently and profitably.

Maintaining a positive cash flow system is vital to a company’s success. A company should organize and track when and where cash goes at all times. Too much debt or having income in overdue accounts receivables can put a company in a negative cash flow. If you’re already using expense tracking software, you can document receipts and invoices in the same platform. Similar to other processes and strategies across your business, I’m of the opinion that constantly reviewing and evaluating your accounting methods is also essential. I believe the best way to prepare is to educate yourself on your business’s tax obligations, keep https://www.bookstime.com/ accurate records, and set aside revenue (or pay ahead in quarterly taxes).

Assets describe an individual or company’s holdings of financial value. In its most basic sense, accounting describes the process of tracking an individual or company’s monetary transactions. Accountants record and analyze these transactions to generate an overall bookkeeping picture of their employer’s financial health. Small business owners and individual taxpayers can also benefit from a strong working knowledge of basic accounting concepts and terms.

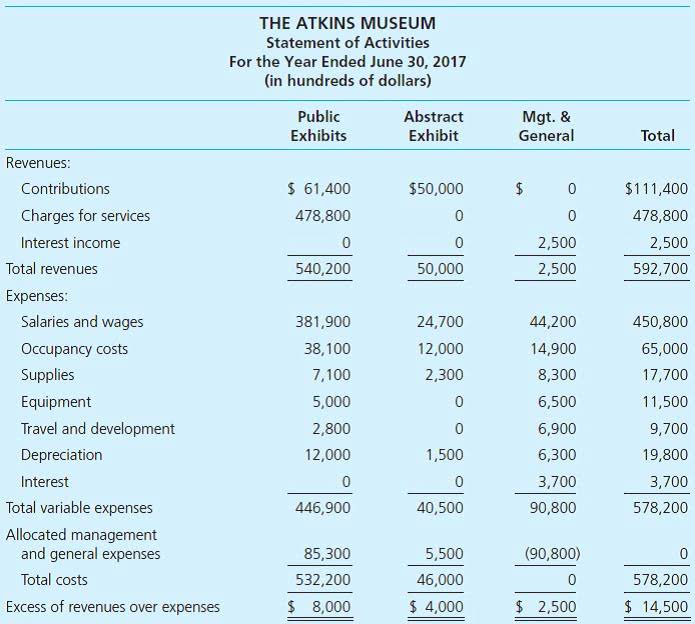

Also, be sure the bank can integrate with your point-of-sale (POS) system and other technological needs. Business bank accounts typically charge more than personal accounts and often have a higher minimum balance. Check these numbers before committing to a bank and a business account. An income statement shows your company’s profitability and tells you how much money your business has made or lost. If you limit your accounting to material transactions, you can save time for your business.

Accounting 101: The Basics You Need to Know

This part of accounting — tax obligation and collection — is particularly tedious. I highly recommend that you work with a professional to at least ensure your business is following the proper procedures and laws. Employees should submit a W-4 form, so you know how much tax to withhold.

Basic Accounting Principles

- If only bookkeeping meant hoarding the paperbacks I overbuy from my local bookstore — I’d be really good at that.

- In my opinion, reducing your COGS is the best way to increase your profit.

- This is done to test if the debits match the credits after the adjusting entries are made.

- Companies with little or no inventory and few employees can use inexpensive or free basic accounting software.

- Look for a bank that has a local branch as well as robust online banking.

Accounting software, including cloud-based programs, is changing the way businesses complete accounting tasks. In some cases, small business owners may be able to do their own accounting, especially with the use of software. At the same time, accountants are increasingly expected to be proficient in using software to support small businesses with their accounting and financial needs.